What investors are saying in today’s market about investing in legendary athlete memorabilia

- Strong Historical Appreciation

- Rare, high-grade sports memorabilia, especially items tied to legendary athletes have consistently outperformed traditional markets during certain periods.

- Example: A 1986 Fleer Michael Jordan PSA 10 sold for approximately $18,000 in 2019, peaked above $700,000 in 2021, and still commands a high six-figure value.

- Low Correlation to the Stock Market

- Unlike equities or bonds, memorabilia doesn't move with interest rates or inflation in the same way. This makes it a strong hedge during market volatility or economic downturns.

- Limited Supply, Growing Demand

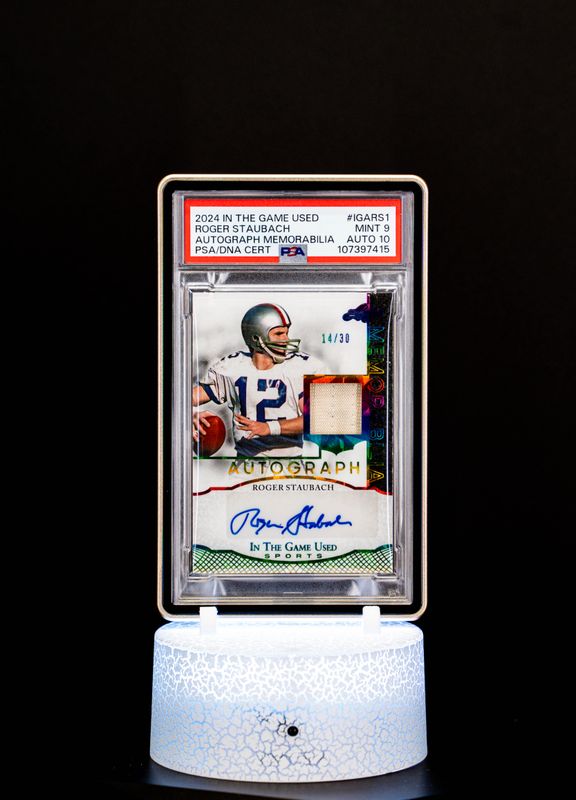

- Supply is fixed or shrinking, especially for vintage or game-used items.

- Demand is growing, fueled by:

- Wealthy collectors

- Pop culture interest

- Globalization of sports

- Rise of auction platforms like Goldin and PWCC

- Cultural & Emotional Value

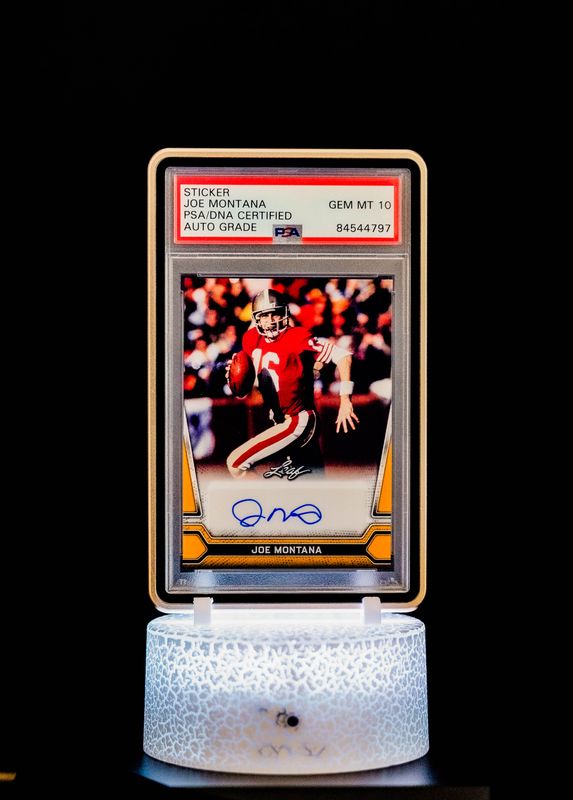

- You’re not just investing in an asset, you’re investing in history, nostalgia, and identity.

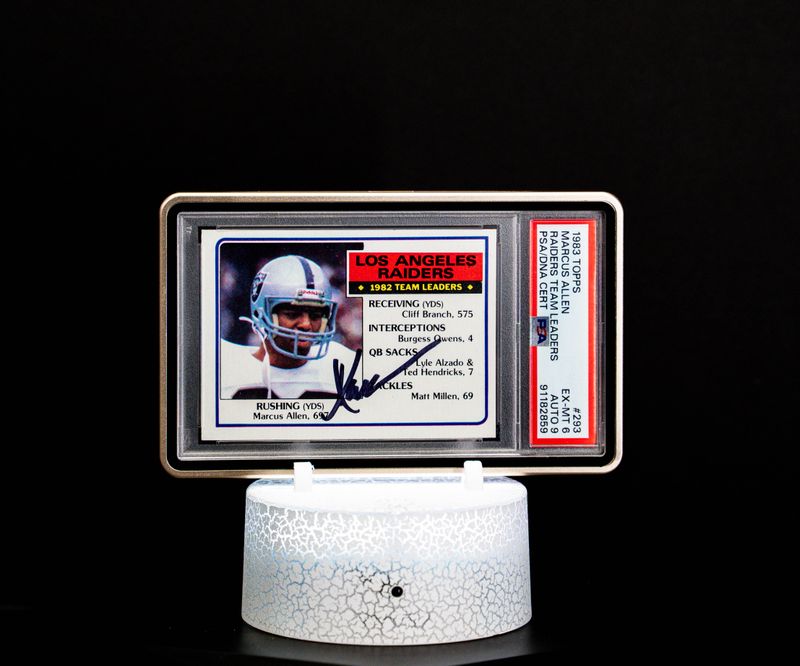

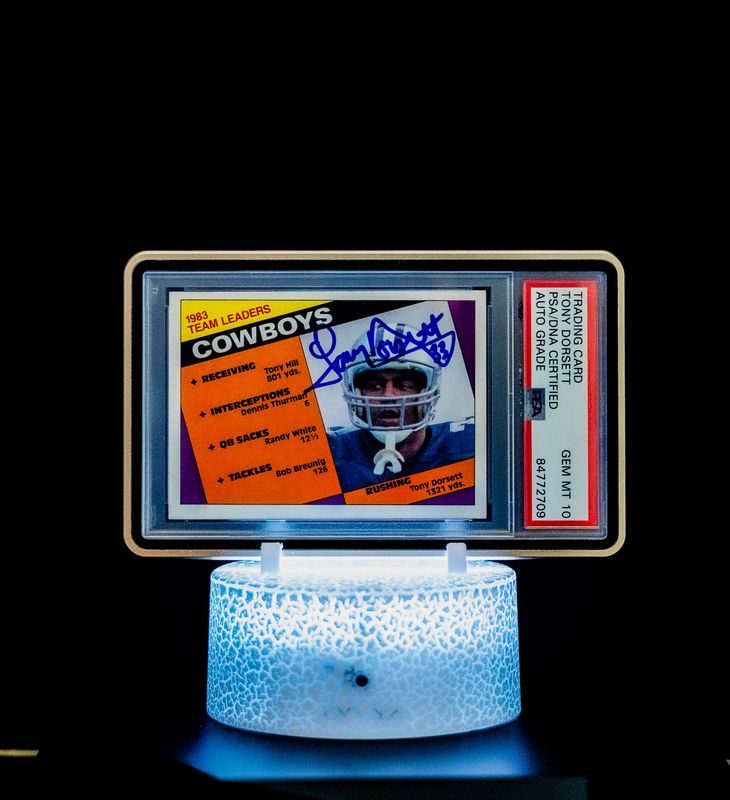

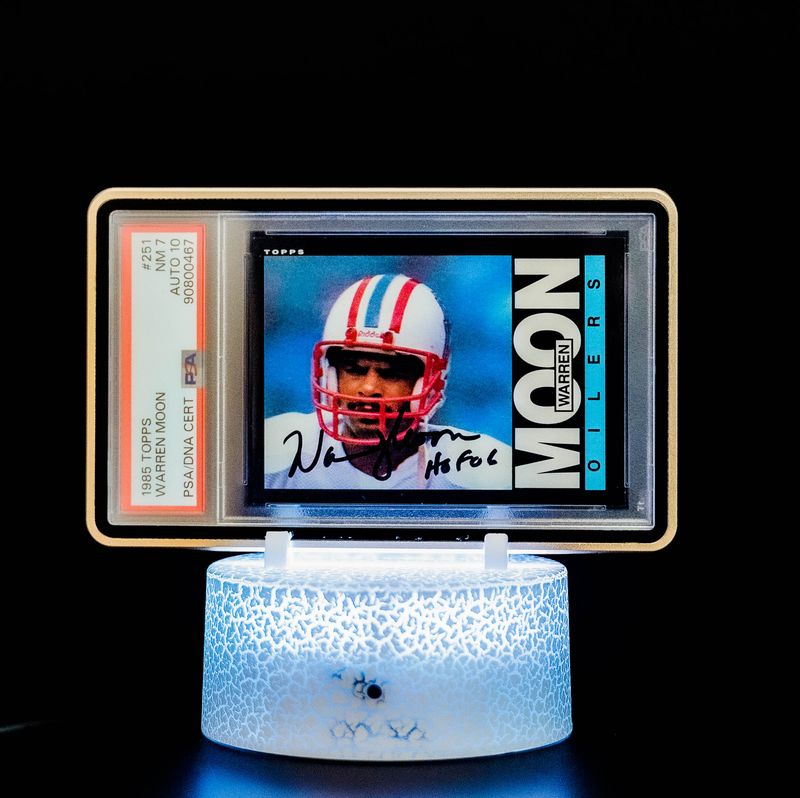

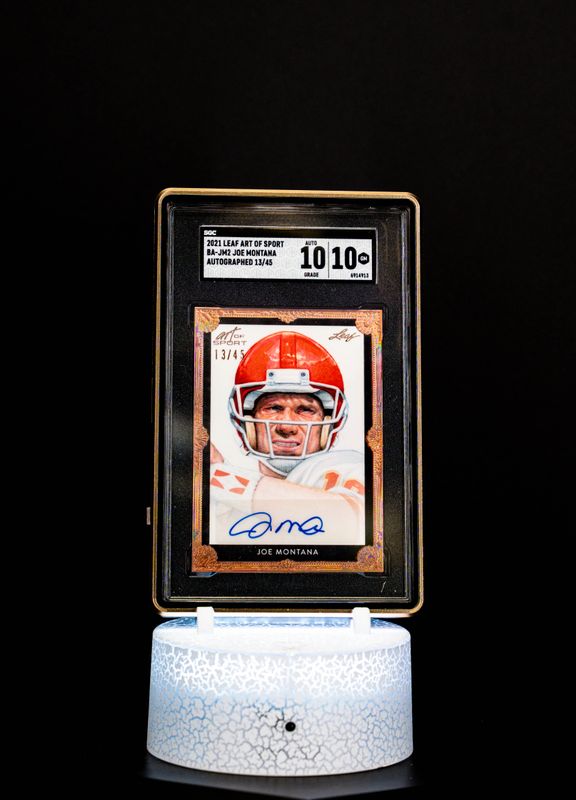

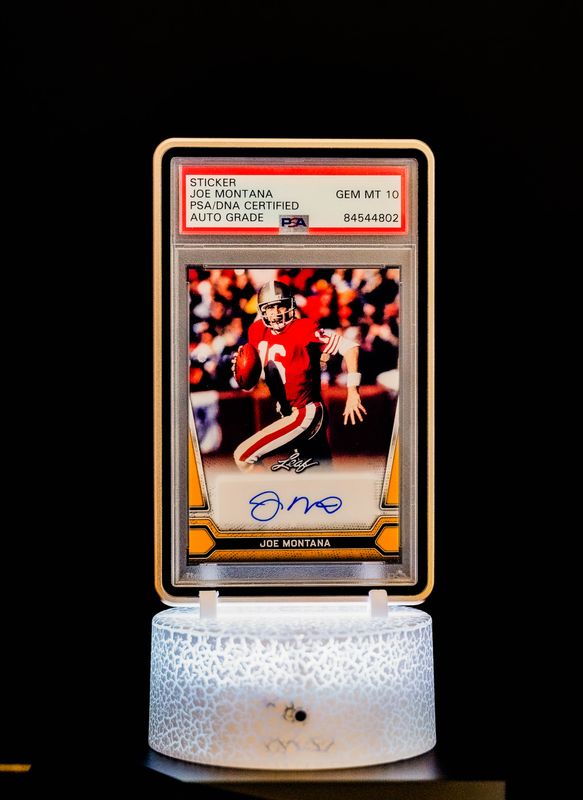

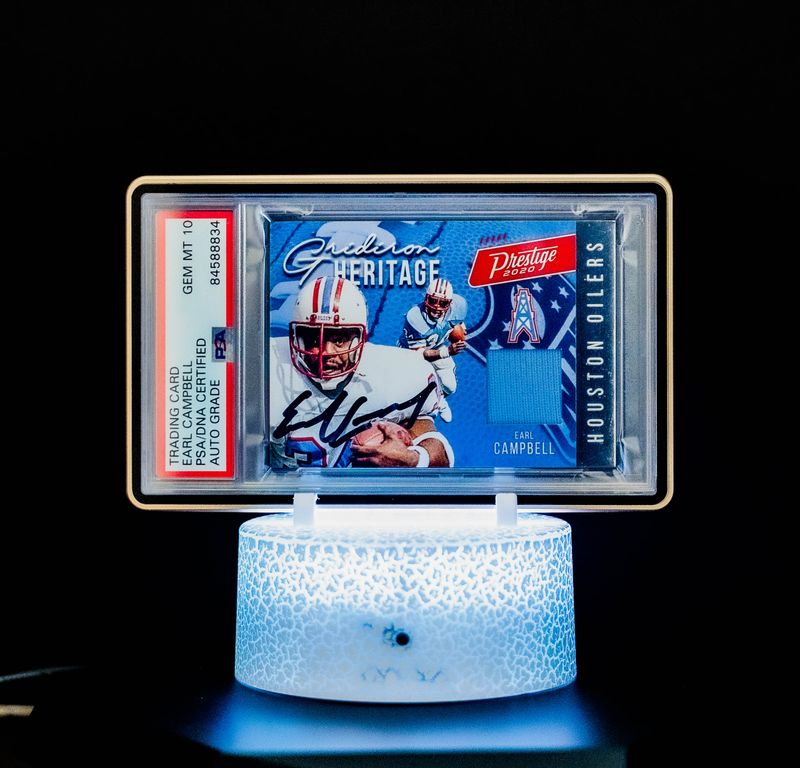

- This adds intrinsic appeal that can boost long-term value, especially with iconic items like signed rookie cards or game-worn jerseys.

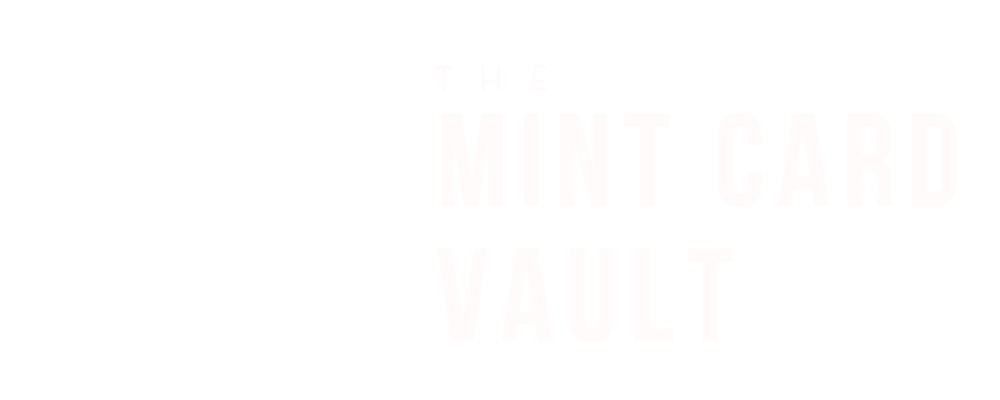

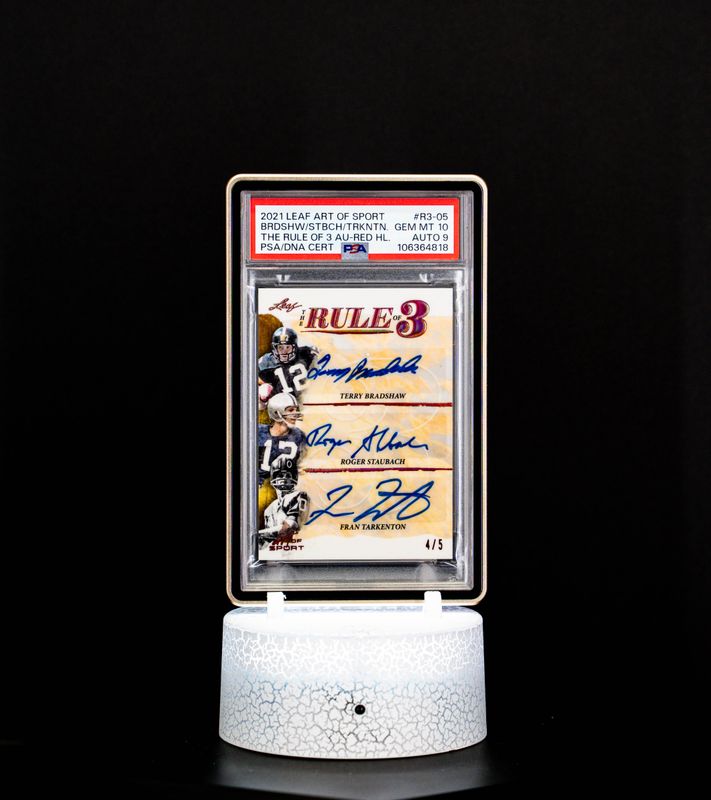

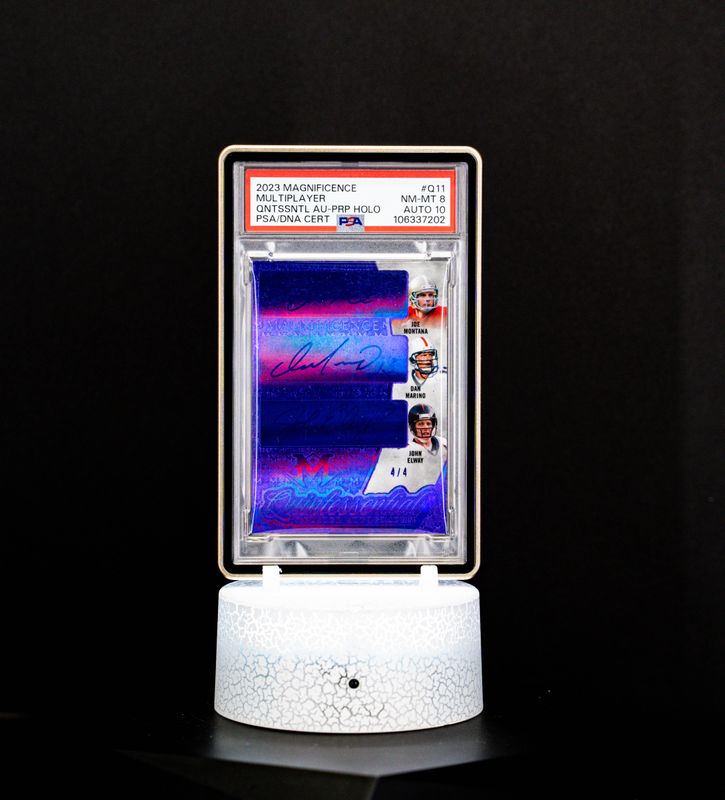

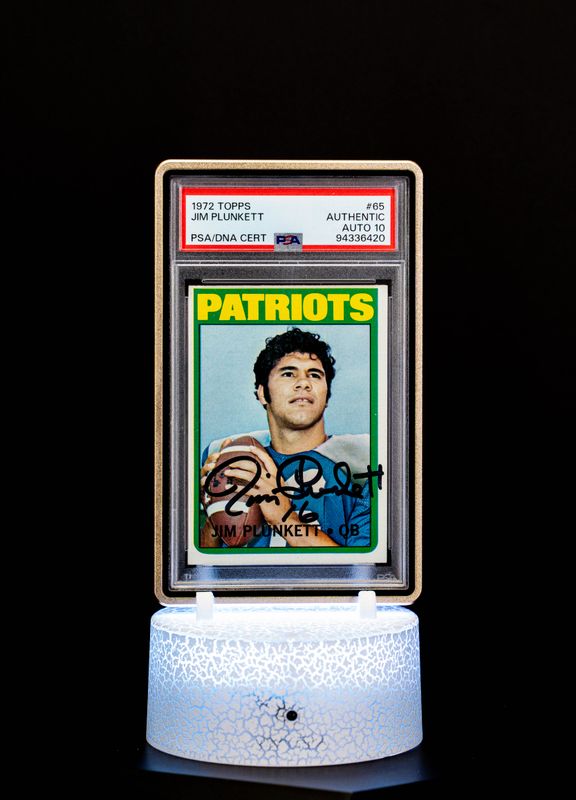

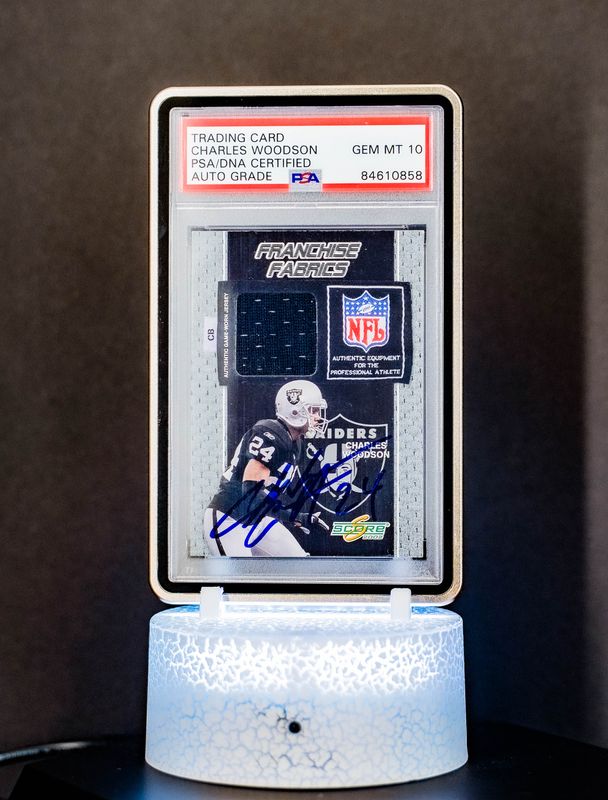

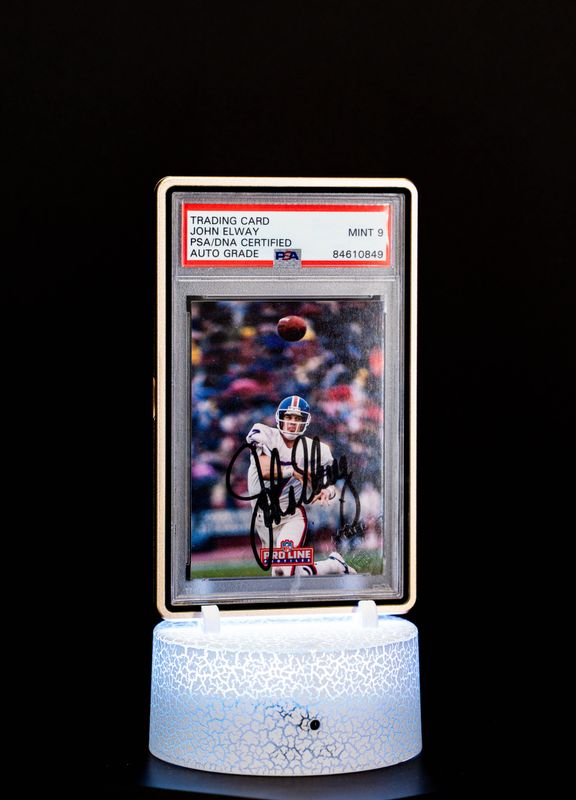

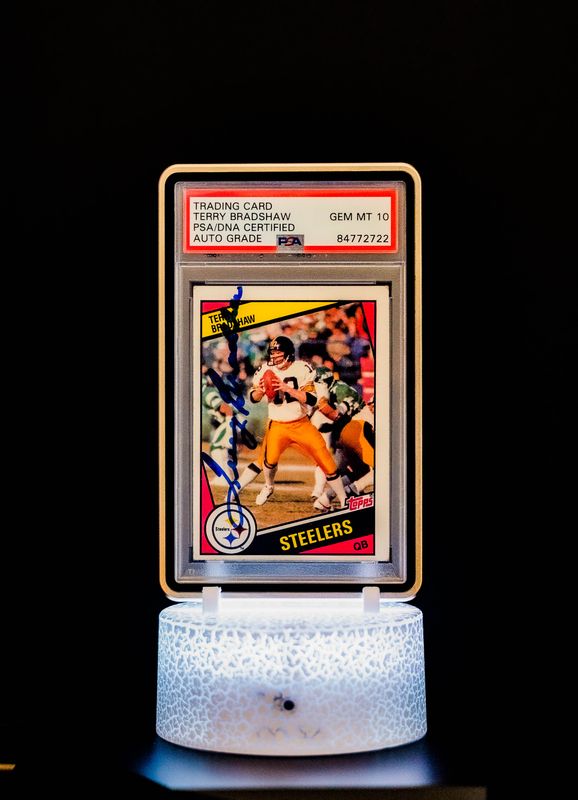

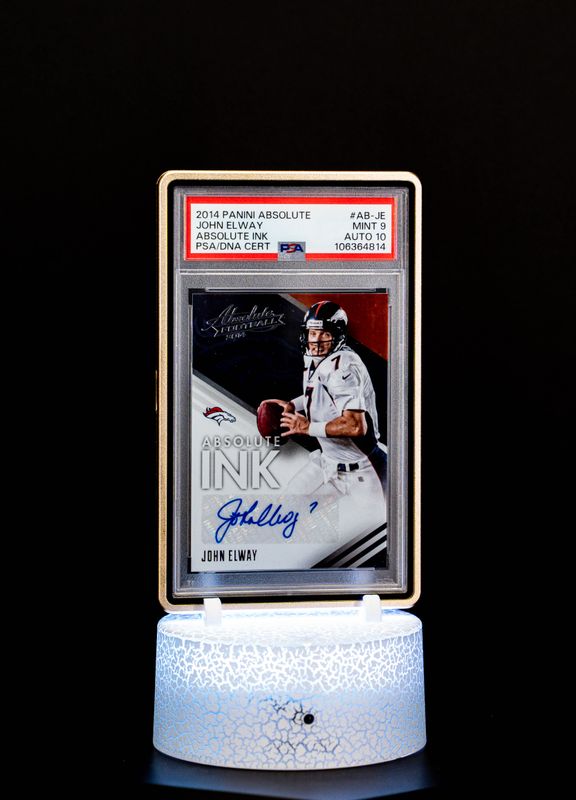

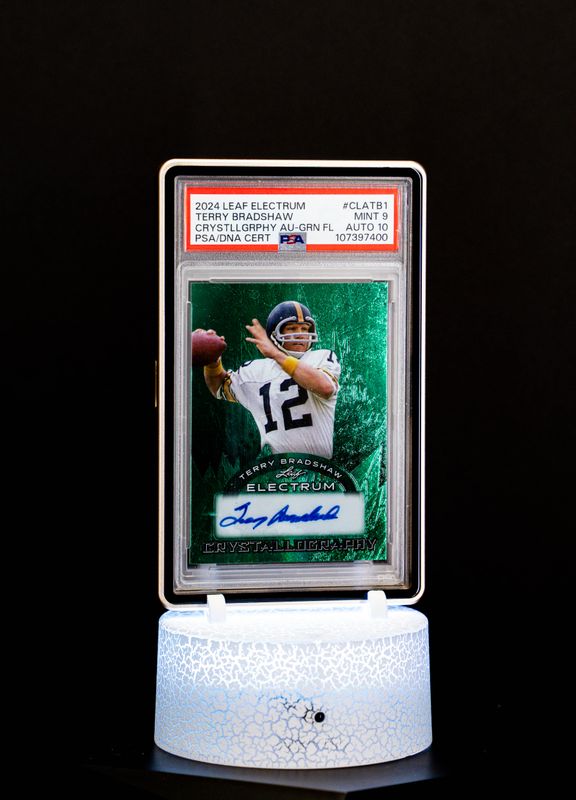

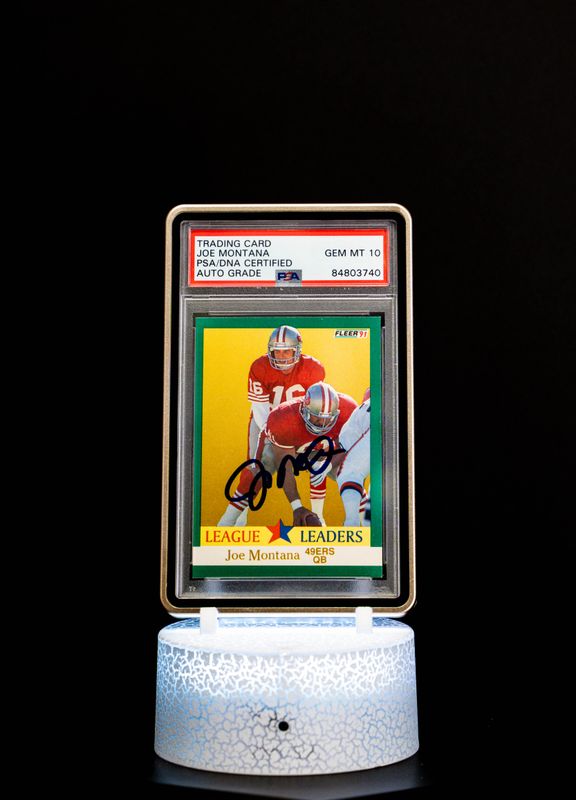

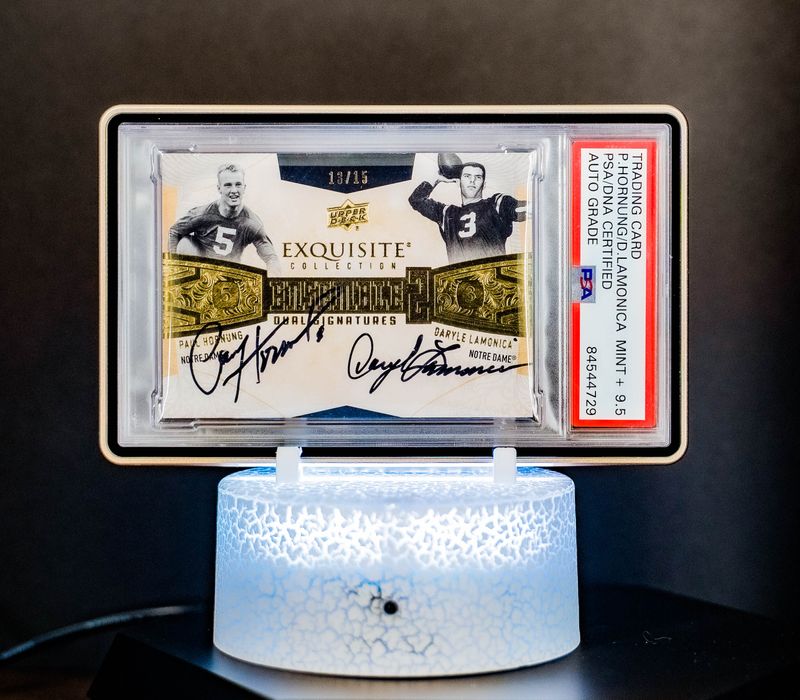

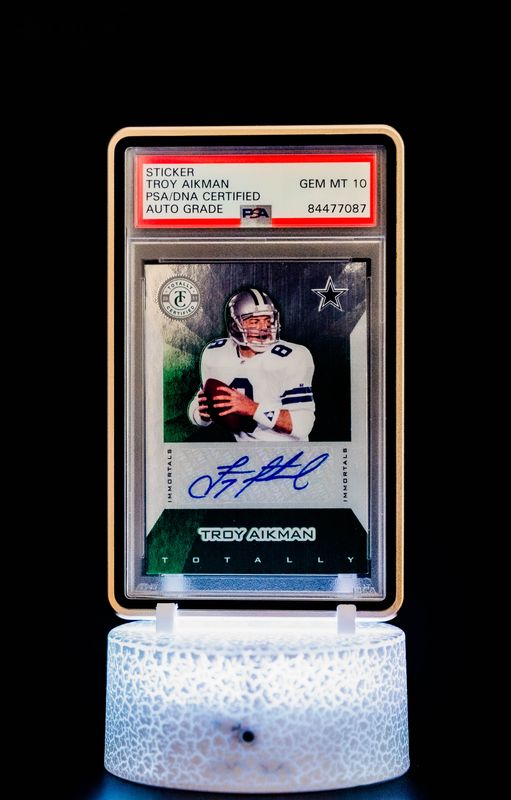

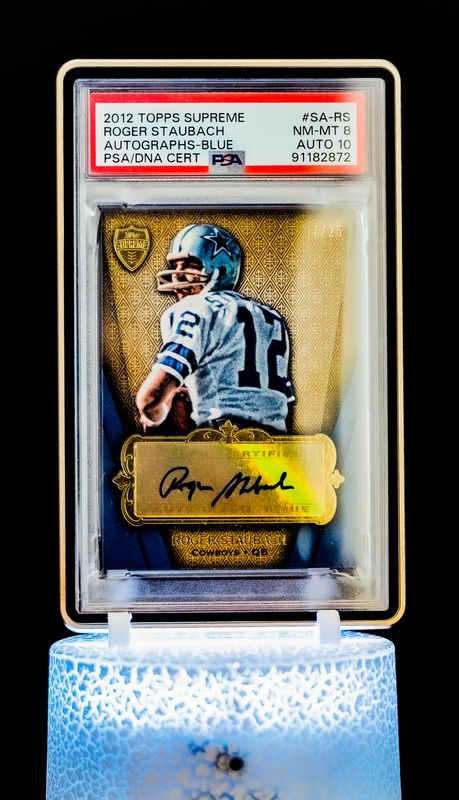

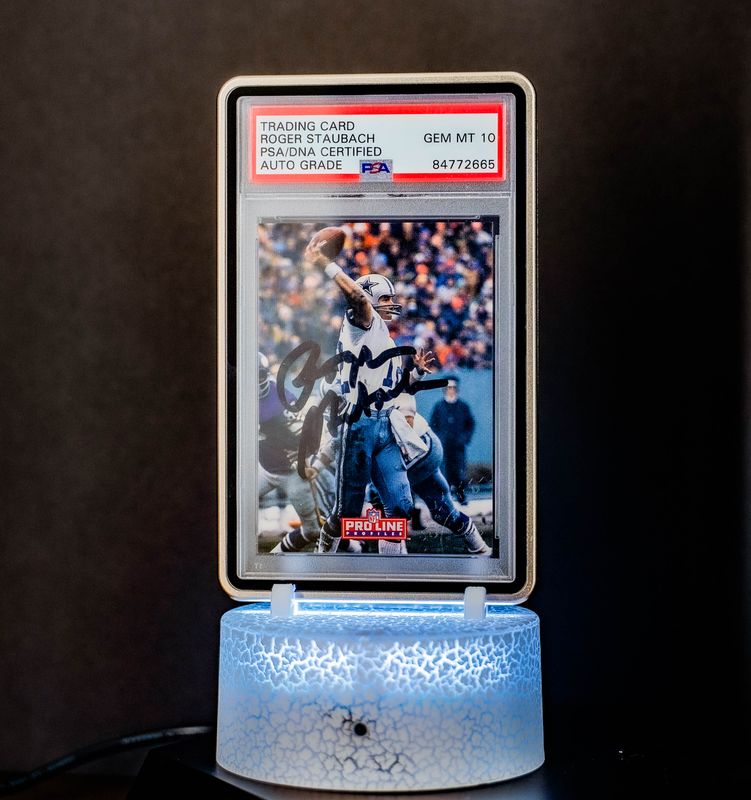

- Authentication & Transparency

- Third-party grading services (e.g., PSA, BGS, JSA) ensure authenticity and help preserve value.

- Population reports and auction data provide market transparency for investors.

- Diverse Entry Points

- You can enter the market at various levels:

- $3K–$20K: vintage cards, game-used items, rare autographs

- $50K+: investment-grade assets like PSA 10 rookie cards or iconic memorabilia

Start investing in legends. Investors are flocking to this market, don’t miss the chance to expand your portfolio.